Payment gateways as we know them today have come into existence after the rise of online commerce in the market. Today, every business engaged in online dealing (whether products or services) is actively showing interest in payment gateway integration. The numbers speak of this popularity, as by 2032, the global payment gateway market will reach around $161bn.

The reason behind this high-end acceptance is the benefits these payment solutions offer to a business. One of the significant advantages or boon for an eCommerce business is the reduced ratio of abandoned carts due to the correct integration of payment gateways. These can be credit cards, mobile payments, or other popular solutions.

However, one needs to be skilled in accurately following the integration process in eCommerce website or app development. Hence, working with a team with hands-on experience can help. They will help in performing every step with clean expertise.

Understanding Payment Gateway Integration

Payment gateways act as an intermediary between users and merchants, facilitating ease in payment transfer by securely authorizing and processing it. This includes collecting payment from credit and debit cards, digital wallets, and more. These are majorly essential for an eCommerce business, as they deal with online goods and services.

The integration process of payment gateway for eCommerce websites or applications typically connects your solution to a payment processing service. This aids a business in accepting online payments efficiently and securely.

How Payment Gateways Work?

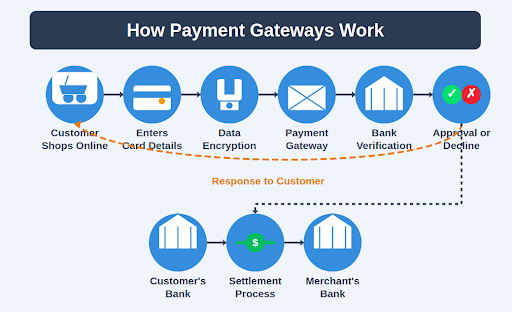

Usually, the working of a payment service provider revolves around the way a user interacts and completes the required process. This is how they work:

- A user initiates the payment.

- Fill in the required details, including name, credit card number, CVV, and more

- The data encryption process is followed by a payment gateway to protect sensitive user data.

- After that, an authorization request is sent from the merchant’s server to payment gateways and the acquiring bank.

- The bank sends details to the card network, which then contacts the issuing bank to perform transaction verification.

- The issuing bank will either approve or decline the request.

- Depending on the outcome, the customer will receive a confirmation of the status.

- After that, eCommerce payment gateway solutions will perform the settlement process.

Types of Payment Gateways

Various payment gateway types are available in the market. The choice among them depends on the specific business needs. Here are some:

1. Hosted Payment Gateway

In an eCommerce website, when a user clicks on performing payments related to the bought products. The user will be redirected to the payment gateway’s website, where he/she will complete the required steps and complete the process.

After completing the process, a user will return to the corresponding website or application from where the products were purchased.

For all the data, these third-party payment service providers stay responsible. PayPal and Stripe are the common examples.

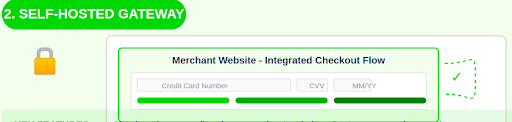

2. Self-hosted Payment Gateway

These are website or mobile payment solution types, which, unlike leaving a merchant’s site or application, complete every payment-related process within. This means that a merchant has complete control over the checkout process. Also, he must follow security best practices like complying with PCI DSS or more for data protection.

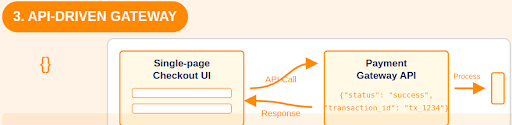

3. API-driven Payment Gateway

As the name states, the payment gateway uses API for a simple checkout process. The payment gateway API integration is pivotal in making the process more seamless by allowing users to stay on one page during the entire checkout process.

4. Local Bank Integration Gateway

These are the types of payment gateways that connect directly with the bank’s very own payment system. This is not used extensively but can help target specific countries where local banks serve as trustworthy and familiar entities. However, its effectiveness depends on the technology used by a regional bank.

How Do Different Types of Payment Gateways Differ From Each Other?

Every payment gateway is different based on how it works, security, transaction fees, etc. Setting up payment on website and application majorly depends on the feature-based comparison.

| Feature | Hosted Payment Gateway | Self-Hosted Payment Gateway | API-driven Gateway | Local Bank Gateway |

| Security Features | Highly Secure | Moderate (merchant must ensure to comply security standards) | Depends on the payment gateway integration. | Changes by Bank |

| Transaction Fees | Generally Higher | Moderate | Varies accordingly | Generally Low |

| Integration Ease | Easy | Moderate | Highly complex requires expertise | Moderate to complex |

| User Experience | Less seamless (redirects) | More control on CX | Highly seamless | Varies |

| International Reach | Often supports international currencies | Depends on the merchant | Typically supports | Limited to the local market |

| Payment Methods Support | Common Payment methods supported | Varies as per merchants | Depends on integration. If done, it offers extensive payment methods | Limited to what the bank provides. |

Popular eCommerce Payment Solution

At this current time, there are various payment solutions available. However, the point to notice is that not every ecommerce payment gateway integration is accessible on both websites and applications like others. Finding the correct ones that work optimally for both might require intensive research and work. Considering this, we have outlined some payment gateways that work smoothly on both platforms.

- Stripe: An API-based payment processor that offers customizable API to send and receive payments.

- PayPal: A digital wallet that ensures users perform secure payments. It’s a hosted payment gateway.

- Braintree: An API-driven payment gateway providing various payment support, from credit cards to digital wallets.

- Authorize.Net: A self-hosted traditional payment processor that ensures secure credit card processing.

- WorldPay: Primarily works with local banks to process payments.

Benefits of Payment Gateway Integration in eCommerce Website and App

Payment gateways serve as a link between users and service providers. In an eCommerce market, its value stays on top due to the benefits it offers to both users and merchants. Here are some of the main benefits it provides:

For Users

If done optimally, payment gateway integration can offer lucrative benefits to users. Some of the highlighting ones are illustrated below:

-

Multiple Payment Options

Every user’s preferred mode of payment is different. Young customers are more likely to use contactless payment due to its convenience. Some choose to use cash or other modes of payment. So, with the integration of Payment gateways, a business can offer these options to users.

-

Quick Checkouts

Accurate online payment gateway integration and a streamlined checkout process with minimal steps allow users to quickly complete a purchase from your store.

-

Better Security

Security is a prominent factor in online shopping, and payment gateway for eCommerce are encrypted to secure sensitive information and reduce the risk of fraud.

-

Easy Convenience

After you invest in eCommerce website development with the right payment gateways, your users can purchase from anywhere with their preferred device type.

For Merchants

Thanks to payment gateways, there is no need to include a Cash Only/ Cash On Delivery option on the eCommerce website or mobile payment solutions. These offer several merchant-specific advantages, like

-

Reduced Cart Abandonment

Earlier, users left a cart at the end step due to the non-functional checkout process or missing payment gateway for website or in-app. Now, with a simplified checkout page and multiple secure options to pay, the cart abandonment ratio can be reduced.

-

Better Sales

The less cart abandonment, the more items you can sell to users. This can potentially boost the sales and profit of your business.

-

Global Reach

You can reach users across global boundaries with secure and internationally approved payment gateway API integration. This helps in expanding the reach of your business to international users.

-

Data Insights

Data is paramount for a business to take further steps to improve itself accordingly. Now, most modern eCommerce payment solutions offer data insights features. This will aid in receiving valuable transactional data, helping them understand user behavior and make decisions accordingly.

A step-by-step Payment Gateway Integration Process for eCommerce Website

An accurately integrated payment gateway can offer the benefits a business wants. However, the road to proper integration is covered by precise steps, and as an eCommerce business, you must follow them to get the working output. Here is a step-by-step process to consider:

Pick a Payment Gateway

First things first, here is the selection of payment gateway. Blindly adding any mode of payment is not worth it unless you follow these selection criteria:

- Check transaction fees of the payment gateway for eCommerce

- Does the selected option follow stringent security measures, like PCI DSS, data encryption, and more?

- How AI-first is it or compatible to be equipped with AI through APIs by opting for AI integration services?

- How compatible is it with your website or platform?

Create a Merchant Account

Once you have adopted a payment gateway for your web store, create a payment gateway online merchant account with easy-to-follow steps. This includes:

- Sign up via email or social login.

- Provide the details of your business (including business name, industry, website URL, and more)

- Fill in personal details (like your name, social security number, bank details, and more).

Get API Credentials

After you complete the above two steps, the next step is to obtain the API keys. These special characters-used keys work as unique identifiers, helpful in connecting a website or an application to the payment gateway’s service.

Set up for Online Payment Gateway Integration

The integration process can vary depending on the payment gateway you select for your business and the website/platform. Platforms like WooCommerce or Shopify eCommerce development offer plugins to simplify and streamline integration. Others, like Magento payment gateway integration, require manual coding, which makes the process a bit complex.

Perform Rigorous Testing

Integration is one thing, and successful working is another. You must continuously test your payment gateway to ensure it works aptly on every browser or device. A specialized team of custom web development services providers can help with this.

Switch to Live Mode

Once you ensure that the payment gateway works as you want, you can switch to the live mode. This makes it accessible to users, who can use it to make purchases. However, ensure the things like SSL certification and PCI compliance to safeguard user’s critical information.

Monitor and Track its Performance

Issues are unavoidable, and a business aiming for sustainability takes this seriously and tracks every bottleneck with expertise. Hence, continuous monitoring of payment gateway integration in eCommerce website holds the most significant value in improving the customer experience.

Payment Gateway Integration in Mobile Application

Some steps remain similar, like choosing a payment gateway, creating a merchant account, and obtaining API credentials. However, some steps differ in mobile application payment gateway integration due to the differences in the development environment. These are:

1. Native Software Development Kit Integration

Whether iOS or Android, each platform has its own dedicated SDK provided by the payment service provider. Here are the steps to follow:

- Install the relevant SDK for every platform

- Utilize it to ensure mobile payment solutions features, like digital wallets, Apple Pay, and more within the application.

- Must check on proper handling of platform-specific authorization and data flows.

2. Device-specific Consideration

Every device has specific pros and cons for payment methods. This is related to screen size or hardware capabilities. Hence, you must focus on choosing the payment mode that works aptly on every device.

3. Prioritize User Experience

This is one of the vital points you must remember while selecting mobile payment solutions for your application. You can consider:

- Designing a simple and quick-to-complete checkout process.

- You must prioritize using the native payment UI (by the platform SDK) for a familiar experience.

4. Security and Compliance

Mobile apps are more prone to cyber-attacks, and this threat increases even more with information like payments. Hence, security measures like data encryption, tokenization, or others must be inspected before opting for mobile payment integration.

5. Testing on Multiple Devices

Mobile phones are of different aspect ratios, and it is quintessential for a payment gateway to provide a similar experience on every device. Hence, testing on cross-devices or emulators is a wise step in payment gateway integration in mobile application. This includes testing minor to major issues and preparing your solution to receive payment from any device.

Must-Consider Challenges While Integrating Payment Gateway for eCommerce

Every process has some challenges that make it highly complex. These might be related to design and technicality. These payment gateway integration challenges are enlisted below, which you must consider:

1. Compatibility Issues

Not every payment gateway works adequately on all eCommerce platforms. So, ensuring compatibility without researching is not a wise option and can impact your web or app’s performance and customer experience.

2. Technical Complexity

Due to technical limitations, you might face difficulties performing certain steps in the integration process. Payment gateway API integration requires expertise to handle each task, from data transfer to encryption.

3. High Transaction Fees

Payment gateways often charge various fees, from pre-transaction to subscription, which can increase the transaction fees. This can impact the revenue of your business.

4. Design-related Issues

The more intuitive and user-friendly your payment gateway will be, the faster a user can use it. Design-specific issues like poor user interface, complex checkout page, and more can confuse users and lead to cart abandonment. You can hire UI UX designers to improve the design and solve this challenge upfront.

How do you Choose the Right Payment Gateway for eCommerce Website and App?

You need to know the challenges in eCommerce payment integration in your website and application before knowing how to pick the right one. Once knowing them, you must check the process that helps you choose the right payment service provider:

1. Consider Web and Mobile-first Features

When selecting a payment gateway for your digital products, you must ensure that it will work adequately with all the features in both mobile and web platforms. Research thoroughly to complete this step as desired.

2. Security and Performance

While performing research, ensure that security and performance are checked. You can do this by actively analyzing the reviews of business owners who used a particular eCommerce payment gateway for their websites.

3. Transaction-related Fees

Keep a keen eye on the transactional fees. Research different payment gateway platforms and analyze the ones that follow security-related measures and offer lower transaction fees.

4. Customer Support

A highly used payment gateway integration solution with optimum customer support. It is essential to have ongoing support from the vendor team for better performance over time.

How Much Does Payment Gateway Integration Cost?

The cost of integrating a payment gateway into your website and mobile application differs due to the hidden factors, like:

- Transaction Fees: Varying fees of different payment gateway service providers

- Tech Complexity: Complexity in the integration of eCommerce website or mobile payment solutions

- Integration Cost: Based on your eCommerce platform, costs can differ. For instance, Magento integration is priced differently than the WooCommerce payment gateway.

- Custom Needs: Including a specific feature, like fraud detection or multi-currency support, can also increase the prices.

- Specialized Team: Hiring a mobile app developer to make the integration process seamless can further add to the cost.

However, the table below provides a general overview of the cost, helping you better understand the price you will have to pay.

| Cost Components | Estimated Price to Pay |

| Set-up Fees | $0 – $500+ (One Time) |

| Monthly Fees | $0 – $50+ |

| Transaction Fees | 1.5 – 3.5% per transaction |

| Simple Integration Using Plugins | $0 – $350 |

| Custom Integration | $500 – $5000+ |

| Developer Fees | $15 – $150/hour |

| Additional Feature | $150 – $1500+ (one time) |

Tailored Payment Gateway Integration in Your Digital Solutions with SparxIT

As we have seen, the integration process, if done correctly, can bring numerous benefits that are helpful for a business like yours to grow rapidly. Correct strategies and expertise are the secret ingredient behind this. Hence, working with a modern-day company like SparxIT can help you achieve the goals you have envisioned.

With over a decade of experience in the industry, our team has provided custom payment gateways to businesses by precisely relating to their needs. Whether it involves integrating payment gateways in AI-first projects or during Fintech app development, we focus on enhancing transaction processes and driving business growth.

Our AI-first eCommerce developers emphasize agile methodology, modern-day requirements, and quality payment gateway integration processes. For projects like Doodern and others, we have added custom-based and advanced payment gateways to their web solutions, making payments more accessible to users. Join the list of companies and make payments seamless and convenient for users with our expert-led services.

Partner with Experts

Frequently Asked Questions

What is PCI-DSS compliance?

PCI DSS is the Payment Card Industry Data Security Standard that protects the crucial information of cardholders against data breaches and fraudulent activities. It is an important compliance that an eCommerce payment solution comprises to strengthen cybersecurity measures.

Why is payment gateway integration important for an eCommerce business?

Receiving payments and improving global reach is crucial for an eCommerce business like yours, and payment gateway integration provides this. This also provides a smooth checkout process and improves customer satisfaction, ultimately driving sales.

What are the latest trends in payment gateway technology for eCommerce platforms?

Various trends are evident, including

- Buy Now, Pay Later (BNPL)

- Omnichannel Payment Solutions

- Cryptocurrency Integration

- Contactless Payments

How long does it take to integrate a payment gateway into an eCommerce website or mobile app?

On average, an essential plugin integration can be completed in 4 to 7 days (depending on the needs). A complex one takes 3 to 4 weeks because of the specific features and custom code. Hence, it is difficult to estimate the time to complete the integration without knowing the requirements and work required. You can contact us to know the exact time.