The insurance industry, traditionally known for its complicated processes, fraud, and slow response times, is undergoing a seismic shift. For far too long, insurers have dealt with issues like manual underwriting, sluggish claims processing, and a lack of data insights. These issues have led to customer dissatisfaction and hindered business growth. AI, however, provides a potent solution for these issues.

With ever-increasing data and quickly maturing cognitive technologies, AI in insurance has become a crucial differentiator. According to Precedence Research’s latest report, the global artificial intelligence (AI) in insurance market was valued at approximately USD 10.82 billion in 2025. It is expected to grow to around USD 141.44 billion by 2034, with an average yearly growth rate of 33.06%.

Innovative artificial intelligence (AI) solutions are implemented in the insurance sector to enhance efficiency, creativity, and personalized customer experiences. Using AI technology, insurance companies can automate repetitive processes, evaluate enormous volumes of data, and produce more precise forecasts.

How is AI in the Insurance Industry Making a Transformative Impact?

Let’s examine how AI revolutionizes the industry and reshapes insurance companies’ functions.

-

AI-Assisted Risk Assessment

With ML development services, especially natural language understanding (NLU), insurers can now examine more abstract information sources, such as Yelp reviews, social media posts, and Securities and Exchange Commission filings, to properly evaluate the insurance carrier’s possible risk.

More precise risk evaluations result in more suitable premiums. A more customized exposure model can significantly impact a market where prices, not products, are the main factor separating insurance firms.

-

Streamlined Claims Processing

AI in the insurance industry can reduce the time it takes to process claims. By processing claims faster, insurance firms can save money on payroll, and the precision achieved by these speedy computations can also result in cost savings.

AI in claims can give agents the appropriate information by making suggestions based on quick data analysis.

AI algorithms enable insurers to promptly analyze claims and forecast possible expenses using images, sensors, and historical data.

-

Smart Underwriting & Pricing

Although the underwriting process is intricate, AI technology can speed up and enhance many related functions.

By automating client data, such as location, marital status, and other demographics, firms can use AI in underwriting insurance to provide more competitive and customized rates.

This can shorten the time required to introduce new pricing into the system and help determine the optimal rate.

-

Advanced Fraud Detection

The Coalition Against Insurance Fraud estimates that insurance fraud costs the insurance sector an estimated $308.6 billion annually.

AI for insurance fraud detection is far quicker and more effective than humans in spotting anomalies in claims data and identifying customer-submitted false information. It can then alert a claims professional to such circumstances.

-

AI-Powered Customer Service

The client interaction point is a significant part of the insurance process. AI chatbot development and virtual assistants in insurance can communicate with customers day or night to answer routine inquiries and offer basic information. Additionally, if you develop an AI-assisted chatbot, it can respond to consumer inquiries and initiate claims quickly.

Furthermore, artificial intelligence enables machines to automatically identify patterns, acquire new insights, and make better judgments.

-

Boost Sales with AI

A competent distribution plan is a critical component of growing a business. Integration with third-party sales tools—AI application development can streamline the process for agents and brokers while opening up new digital sales channels and tactics.

-

Reduced Human Errors

Interactions between clients and insurance experts have entailed manual data input and several stakeholders, which increases the possibility of human error when information is transferred.

By using AI in mobile app development, insurers can check for and maintain consistent data while expediting different procedures and eliminating the need for data reentry.

-

Proactive Risk Prevention

Using advanced data analytics services, AI enables insurance agencies to swiftly examine intricate information, such as past claims records, client demographics, market trends, and environmental data. AI-powered insurance solutions can help evaluate loss data and predict future hazards with predictive modeling.

AI, for example, can assist insurers in analyzing a client’s overall risk appetite, providing valuable insights for the company.

Additionally, this data can be utilized to forecast future troubles, enabling insurers to provide customized, one-on-one advice to clients and anticipate problems before they result in substantial losses.

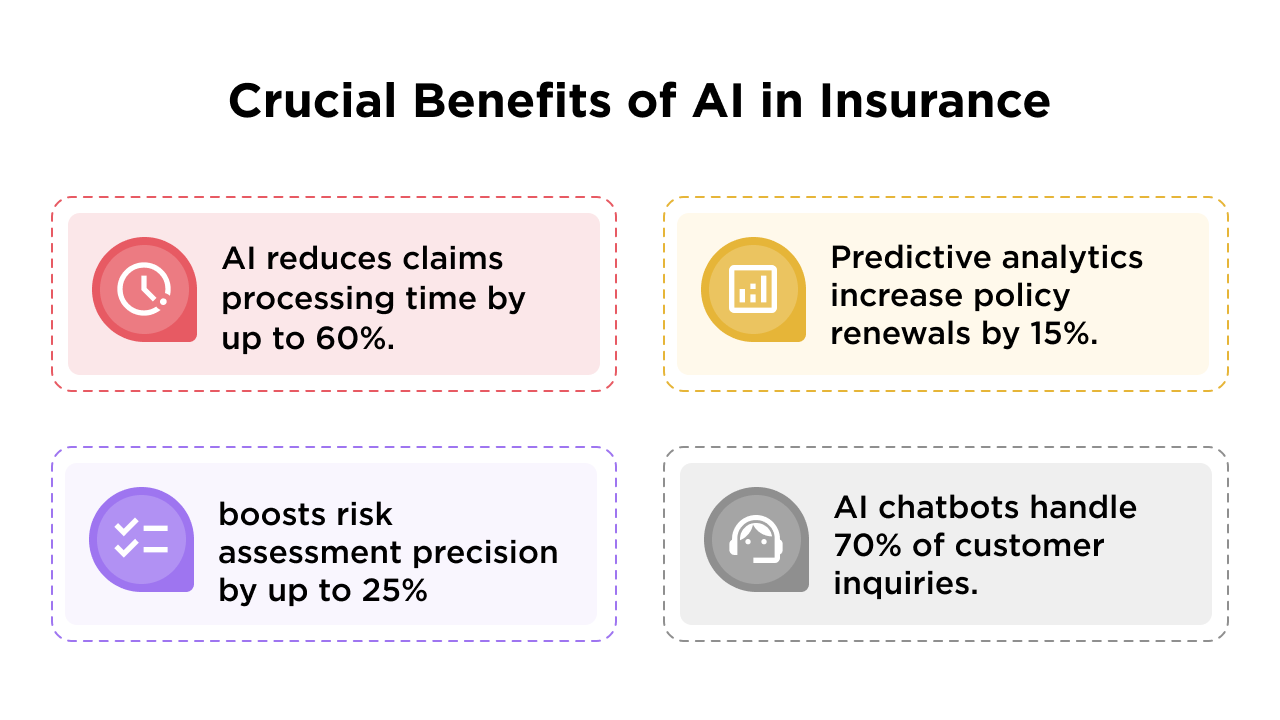

Tap Into the Crucial Benefits of AI in Insurance

Leverage AI in insurance to improve operational efficiency, reduce costs, enhance fraud detection, and offer customer-centric policies.

-

Simplified Claim Management

AI and ML in insurance may be used with other applications to expedite the fraud detection process, saving time by controlling all the procedures of data collection, claims formation, authorizations, approvals, payment tracking, and recovery tracking.

-

Enhanced Operational Efficiency

Chatbots are the simplest method of starting the process and spreading the information to the next aligned step, ensuring a seamless, rapid, and error-free process without human participation. Moreover, generative AI for enterprises can upsell and cross-sell insurance products based on a customer’s past purchases and profile.

-

Accurate Loss Estimation

With the recent developments in AI technology, such as machine learning, deep learning, and OCR, evaluating damage has never been simpler. Determining the level of damage can be done quickly and effectively by just submitting an image of the damaged item. Furthermore, these technologies enable the forecasting of losses and provide insightful suggestions.

-

Next-gen Predictive Analytics

Insurance professionals can access a wealth of data, including actuarial figures, policy information, loss records, customer demographics, and risk assessment trends. However, because of its complexity, this data can be complex to digest or kept in separate systems for multiple organizations.

This might make it challenging to perceive the big picture when working with customers and giving advice. Organizations can store all their data in one place and use large language models to analyze mission-critical data more quickly with insurance app development.

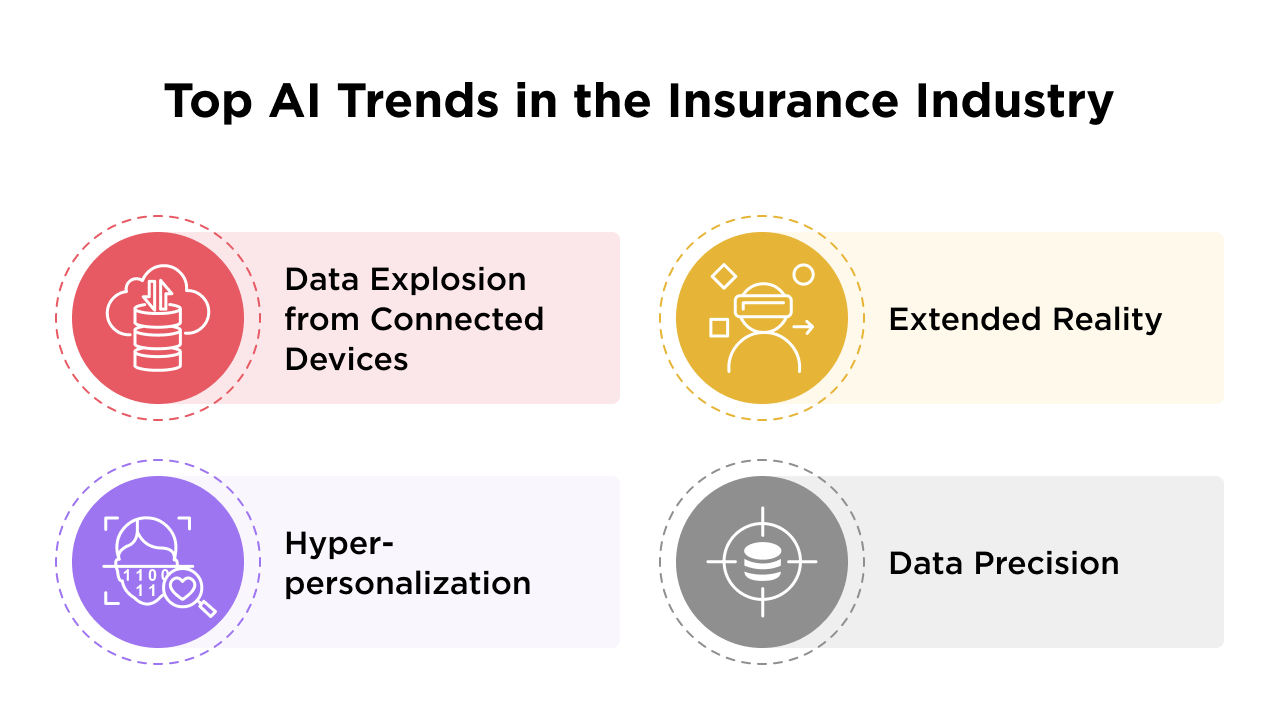

Top Artificial Intelligence Trends Shaping the Insurance Sector

Artificial intelligence’s fundamental technologies are already used in vehicles, homes, businesses, etc. By adopting AI, insurance companies can accelerate their digitization goals. Additionally, embracing change will put them in a better position. Several key AI trends are reshaping the insurance business. Let’s explore them one by one.

-

Data Explosion from Connected Devices

Data generation has skyrocketed due to the proliferation of connected devices. A data explosion results from vast amounts of data collected and transmitted by IoT sensors and smart devices.

Banking & financial software development can handle, evaluate, and use this data flood well to remain competitive in the modern digital environment.

-

Extended Reality

Extended reality is a more sophisticated version of virtual reality. The insured object does not have to be physically present at the location. Once the claim is filed, AI can conduct a virtual examination. Better rates based on the car’s safety features will be easier to offer.

-

Hyper-personalization

With the combination of AI and insurance, insurance firms can offer highly customized plans and solutions tailored to each customer’s demands. Predictive analytics in insurance may provide personalized insurance plans by examining lifestyle, behavior, and data.

In today’s highly competitive insurance industry, delivering personalized services has become a key differentiator. This level of customization can be achieved by collaborating with app development experts who focus on building intuitive, secure, and high-performing solutions. Through custom insurance software development, businesses can automate claims processing, enhance customer engagement, and streamline internal operations, all while ensuring scalability for future growth.

-

Data Precision

Data is king when it comes to combining insurance and artificial intelligence. AI technology gathers information from several sources and interprets it. Nevertheless, better business judgments can be made if the data is reliable. Insurance businesses can employ big data analytics services to utilize precise data to reduce risks.

Top Companies Using AI in Insurance Industry

- Lemonade: This digital-first insurance company uses AI for fast claim processing, underwriting, and personalized customer experience, providing seamless service to policyholders.

- MetLife: MetLife leverages AI to enhance underwriting decisions. Their AI-powered chatbot, MetLife Assist, offers customers instant answers to their queries.

- Allianz: This insurer integrates AI in claims automation, fraud detection, and risk assessment, which increases efficiency and reduces operational costs while providing more accurate risk management solutions.

- State Farm: Uses AI for fraud detection, customer interaction, and claims processing, which improves service productivity and reduces TAT for policyholders.

- Progressive: Utilizes AI-driven telematics and predictive analytics for custom pricing and improves risk management for auto insurance.

Addressing AI Challenges in Insurance with Effective Solutions

The insurance industry is facing unprecedented challenges due to the rapid advancement of AI. To ensure its continued success, it is imperative to address these challenges proactively.

-

Legacy System Integration

Integrating AI with legacy systems can be challenging due to their age and complexity.

Solution: Insurance companies should adopt a phased approach. They should begin with smaller-scale AI implementations and gradually integrate APIs for a smooth data flow. You can replace and re-architect your outdated insurance systems with legacy system modernization.

-

Regulatory Compliance Issue

AI algorithms can raise data privacy and transparency concerns, delaying AI adoption in the insurance sector.

Solution: Stay updated on global and local regulations (e.g., HIPAA, GDPR, CCPA) and implement a stringent compliance framework. Insurers can conduct regular audits and apply data protection measures to remain unbiased.

-

Data Quality & Integrity

The data quality used to train AI models can impact decision-making, accuracy, and reliability.

Solution: Invest in data cleaning and validation procedures to ensure data accuracy and integrity. Additionally, data governance practices should be incorporated to maintain data quality and reduce the risk of errors.

-

Cybersecurity Vulnerabilities

AI systems are the primary targets for cyber threats, like data breaches and unauthorized access.

Solution: Adopt multi-layered encryption, which includes network security, endpoint protection, and continuous vulnerability assessments. In addition, consult with a cybersecurity consulting services provider that can detect and respond to threats in real-time.

Exploring the Future of AI in the Insurance Industry

New technology and methods are continuously changing the business environment. AI will become impossible to ignore as it integrates into many businesses and daily life. The insurance sector operates in a fairly conventional manner. Still, if insurance companies and their agents wish to be competitive and successful, they must use digital transformation services to realign their insurance business with technological advancements.

Claims, underwriting, processing, and other significant insurance-related tasks are here for the long run. Implementing AI in the insurance sector can help further optimize the sector’s workflows, productivity, and other aspects.

How Can SparxIT Help Drive AI Innovation in the Insurance Sector?

SparxIT can significantly contribute to the insurance industry by using our in-depth knowledge and expertise to develop next-gen AI-powered solutions. We are a leading AI transformation services provider building customer-centric and AI-driven insurance apps that streamline workflows, enhance customer experience, and increase your bottom line.

For example, our recent partnership with Niva Bupa UNO resulted in a custom app with a top-notch online induction and training solution. This app has AI-assisted personalized learning pathways, a user-friendly UI/UX design, and gamification. This software helps agents sell insurance products more effectively and makes it easy for agency managers to onboard new agents.

Partner with Experts

Frequently Asked Questions

How can artificial intelligence make insurance processes faster and easier?

AI streamlines processes of underwriting, claims handling, paperwork, and customer interactions and eliminates human bias for faster turnaround times and reduced administrative burdens.

How is AI used in insurance customer service?

AI-powered chatbots and virtual assistants can handle customer inquiries 24/7, offer personalized product recommendations, automate complaint handling, predict customer churn, and assist with policy management.

What impact does AI have on claims processing in the insurance industry?

AI accelerates claims processing by automating tasks, eliminating manual errors, analyzing documents in real-time, and reducing processing costs by 50-65%. This leads to faster claim settlements with better tracking and visibility.

What are the crucial benefits of AI in the insurance sector?

AI-led predictive models forecast trends, detect fraud, automate claims, personalize policies in the insurance sector to improve customer experiences, and enhance decision-making capabilities.