What if a bank could predict your financial needs before realizing them? What if it could advise you on the best investment options based on your spending habits, financial goals, and market trends? With AI-driven solutions, this is becoming true in the finance industry.

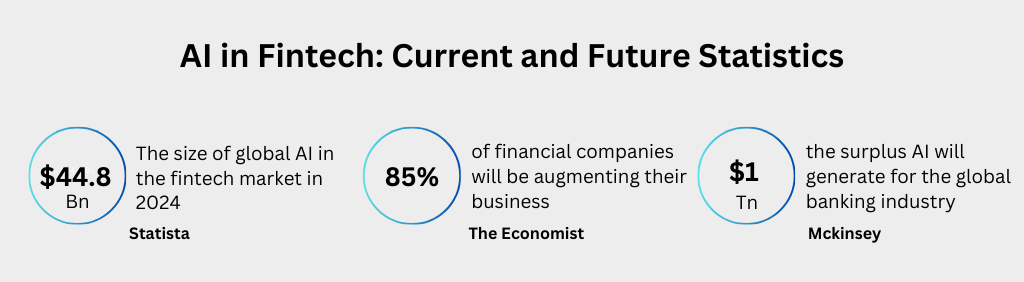

AI in Fintech has emerged as a game-changer. This technology streamlines operations, provides better services, and predicts financial trends precisely. Major financial institutions have adopted AI, especially generative AI.

This market is expected to grow from $1.9 billion in 2023 to $12 billion by 2033. This exponential growth showcases various business opportunities to invest in and make the most of.

However, proper AI integration is a challenging task. It requires expertise and experience. Here, a team providing top-tier AI development services is invaluable in quickly providing exceptional customer service.

The Role of AI in Fintech

Artificial Intelligence (AI) in Fintech focuses on applying intelligent algorithms and data processing techniques to optimize financial services. Its impact spans risk management, fraud detection, customer engagement, and personalized financial recommendations.

The usage of AI in financial services leverages key technologies such as:

- Machine Learning: Enabling systems to learn and analyze historical data to predict trends, automate processes, and detect anomalies.

- Deep Learning: A subset of ML, allowing for even more sophisticated analysis of large datasets, often with applications like facial recognition and customer sentiment analysis.

- Natural Language Processing: It allows machines to understand and interpret human language. Chatbots, voice assistants like Alexa, and voice-enabled navigation systems are popular examples.

Together, these AI technologies are rapidly transforming Fintech, making financial operations faster, more secure, and tailored to individual needs.

What are the benefits of AI in Finance?

Integrating AI for financial services has provided many benefits that make the entire industry more agile, efficient, and customer-centric. Let’s break down the key advantages:

Cost Savings

AI helps financial institutions reduce overheads by automating repetitive tasks and using predictive models to avoid costly mistakes. AI-powered chatbots are the prime example of automating routine operations.

Improved Efficiency

A finance-focused agency can quickly analyze large datasets with the help of AI. This improves their decision-making ability and makes them accurate most of the time. It helps in:

- Seamless loan processing

- Improving millisecond trade

- Quickly identify potential risks and outcomes

However, to leverage this and improve the efficiency of the financial institute, it is wise to consult the pros and cons with an AI consulting company. They can provide valuable insights and tailored solutions for your specific project needs.

Enhanced Risk Management

AI provides real-time risk monitoring by identifying patterns and predicting financial downturns or fraud attempts. By automating risk analysis, institutions can react faster to potential threats.

Data-driven Insights

The data processing power of AI allows financial companies to extract actionable insights that were previously difficult to detect. This can improve decision-making in building investment strategies or enhancing customer experience.

Key AI Use Cases in Finance

Automation is one of the AI applications in FinTech, and it has significantly improved over time. As a result, AI’s use in the industry has increased. Now, every Fintech-first institution invests heavily in AI model development to create effective finance solutions. Here are some of the use cases and related AI in fiance examples that you must check out:

Real-time Transaction Monitoring with AI

AI models monitor real-time financial transactions, detecting fraudulent activities by analyzing patterns and anomalies. Machine learning in financial services identifies suspicious behaviors, such as unusual spending, enabling banks to prevent fraud instantly.

PayPal uses a sophisticated AI-driven fraud detection system to monitor transactions and potential card fraud early.

AI-driven Algorithmic Trading

Machine learning in finance can predict market movements, optimize strategies, and execute trades precisely and quickly, improving decision-making.

Example:

BlackRock employs AI algorithms to optimize trading strategies and execute trades quickly.

AI for Financial Analysis

AI can analyze large volumes of financial data to provide insights and forecasts. For instance, Kensho, a subsidiary of S&P Global, uses this technology to analyze market data and provide financial analysis, which helps improve financial advisors’ decision-making abilities.

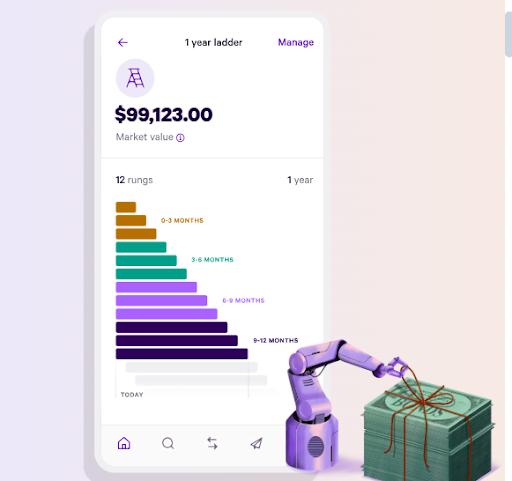

AI Portfolio Management

AI can automate various processes based on real-time data, including asset allocation or portfolio adjustment. Machine learning algorithms analyze market trends, risk factors, and client profiles to optimize diversification and improve investment return.

Wealthfront uses the power of machine learning and artificial intelligence in finance to enhance investment strategies and make it more affordable and accessible to users.

Personalized AI Finance planners

The advent of AI has significantly reshaped every industry. In finance, AI agents provide personalized financial advice by analyzing users’ spending habits, income, and goals.

A popular example of AI in finance is Cleo, an AI-powered budgeting app offering tailored saving strategies and financial insights.

Robo-Advisors

Robo-advisors provide automated, low-cost investment advice to users. They assess an individual’s financial goals, risk tolerance, and time horizon to build diversified portfolios.

Betterment Robo-advisors are making investing more accessible to retailers with minimal human intervention.

Enhanced Cybersecurity with AI

AI enhances cybersecurity in finance with real-time threat detection. Machine learning models analyze user behaviors, transaction patterns, and system vulnerabilities to identify anomalies and block data leakage and cyber threats before they can compromise sensitive data.

Darktrace uses ML models to analyze user behaviors and transaction patterns and block potential cyber threats.

Conversational AI in financial services

Chatbots transmute customer services and are prime examples of conversational AI in financial services.

Bank of America’s Erica is a virtual financial assistant that helps customers with inquiries, account management, and financial advice, available.

Essential Features of AI Solutions for Finance

AI is impacting operations and decision-making with its features. It leverages ML algorithms, NLPs, and other advanced techniques to optimize trading, credit assessment, and risk management. The key features of AI in banking and finance are illustrated below:

AI based Credit Scoring

AI-driven credit scoring models use large datasets, including traditional and alternative data sources, to assess an individual’s or a business’s creditworthiness. Traditional credit scoring systems rely on limited data, whereas AI in financial services can incorporate broader financial behaviors, enabling more accurate credit risk predictions.

Automation in finance

AI-powered automation in finance plays a critical role in streamlining repetitive tasks. Process Automation (PA) and Robotic Process Automation (RPA) allow financial institutions to reduce human intervention, thus lowering operational costs and improving efficiency.

AI Predictive Modeling

A financial institution can use AI to analyze historical data, behaviors, events, or other factors that make predicting future outcomes easier. Machine learning in finance can process vast amounts of structured and unstructured data to identify patterns and relationships humans may overlook.

AI Risk Mitigation

AI solutions in finance enable more precise and dynamic AI risk assessment and mitigation by analyzing a broad spectrum of data sources. Unlike traditional models, AI can assess qualitative and quantitative factors, helping identify emerging risks faster.

Challenges of AI in Finance

While artificial intelligence in finance offers immense potential, it also comes with significant challenges. You must address them before integrating AI into operations. These obstacles hinder the adoption and effectiveness of AI in financial services, making it essential for organizations to balance innovation with caution.

| Challenge | Impact | Potential Solutions |

| Insufficient Data | AI models may produce inaccurate insights or fail to identify trends due to data silos, regulatory constraints, and poor data quality. | Implement data integration strategies, ensure regulatory compliance, and use data augmentation techniques. |

| Algorithmic Bias | This can lead to biased lending practices, unfair credit scoring, and discriminatory financial decisions. | Use diverse training data, conduct bias audits, and implement fair AI practices. |

| Cybersecurity Risks | AI-powered systems are vulnerable to fraud, hacking, and data breaches, risking financial loss and reputational damage. | Strengthen AI-driven cybersecurity, use fraud detection models, and implement robust encryption & access controls. |

| Model Interpretability | Lack of transparency makes it difficult to explain AI decisions, affecting regulatory compliance and customer trust. | Adopt explainable AI (XAI) methods, implement auditable AI models, and ensure regulatory alignment. |

Essential Considerations While Adopting AI in Fintech

Adopting AI requires careful planning and consideration in fintech. Sometimes, it can be challenging to complete this process with precision. This is where an ML development company plays a pivotal role. An expert team can design and implement AI solutions tailored to your needs by considering the essential points like:

Data Quality

It is a significant challenge in finance due to issues like data silos, inconsistent formats, and incomplete datasets. Financial institutions often struggle to consolidate diverse data sources, affecting the performance of AI models. To address this, you require:

- Robust data governance frameworks

- Data cleaning practices

- Integration tools to ensure data consistency.

Transparency

This is crucial for building trust in AI systems, particularly in fintech. Explainable AI (XAI) ensures that the decision-making process behind AI models is understandable to humans. XAI helps demystify the algorithmic processes and foster trust among users by providing insights into how decisions are made.

Cost and Infrastructure

Adopting AI in fintech app development can be expensive, particularly in infrastructure and maintenance. Financial institutions must carefully assess the total cost of ownership, considering infrastructure scalability, cloud services, and AI expertise to optimize long-term investment.

Ethical Considerations

Bias in AI models, driven by skewed data, can lead to discriminatory practices, while automation may reduce the need for human labor. Financial institutions must address these issues by promoting fairness, inclusivity, and ethical transparency in AI development and deployment.

Regulatory Compliance

Compliance with frameworks like the General Data Protection Regulation (GDPR) and Anti-Money Laundering (AML) laws is essential to ensure that AI solutions operate within legal boundaries. Machine learning development companies must design AI systems that respect data privacy rights and detect fraudulent activity for regulatory review and accountability.

Integration With Existing Systems

Successful integration maximizes the potential of financial institutions to operate more effectively in the industry. That is why AI integration services from a reputed team can help ensure an institution maximizes the power of AI in financial operations.

The Future of AI in Fintech

AI constantly evolves, and we are evident with new and better changes every quarter. The future of AI in the finance industry is bright with various new and improved techniques.

Open Banking

AI facilitates open banking. AI in mobile app development allows developers to build mobile app solutions around financial institutions. This promotes transparency and competition, enabling consumers to access a broader range of financial products.

Generative AI in Finance

Generative AI in finance will enhance decision-making processes, streamline operations, and foster innovation in product development across the financial sector. Partnership with the right generative AI development company can help implement this trend completely.

Central Bank Digital Currencies (CBDCs) and AI

AI is crucial in developing and implementing Central Bank Digital Currencies (CBDCs). By analyzing transaction data and user behavior, AI can enhance the efficiency and security of digital currency systems. This integration promotes financial stability, improves monetary policy effectiveness, and facilitates seamless cross-border transactions.

Decentralized Finance

Decentralized finance (DeFi) leverages AI to enhance financial transaction transparency, security, and efficiency. Artificial Intelligence can automate lending, trading, and insurance processes using smart contracts and blockchain technology for financial services and fostering a more inclusive financial ecosystem.

AI and Financial Inclusion

This technology is pivotal in promoting financial inclusion by providing underserved populations with access to financial services. Through advanced data analytics, AI can assess creditworthiness for individuals lacking traditional credit histories, enabling fintech companies to offer tailored products.

The Metaverse and Fintech

Virtual environments can facilitate digital banking, investment simulations, and financial education. AI enhances these experiences by personalizing interactions and providing real-time insights, ultimately transforming how consumers engage with financial services in a virtual landscape.

Why Partner With SparxIT for AI in Fintech Project?

The integration of AI in Fintech has revolutionized the financial landscape. When appropriately integrated, AI offers many advantages. Though integration is challenging, it is highly recommended that an expert company help achieve it. SparxIT can significantly assist in this.

As an experienced AI development company, we have a proven track record of delivering modern-day AI solutions tailored to the unique challenges and opportunities within the financial technology sector. Our expertise spans various AI applications in Fintech, including fraud detection, risk management, customer service automation, and personalized financial advice.

When you hire AI developers from us, they will help you overcome the intricacies of the financial industry and develop solutions that drive tangible business outcomes.

Want to Incorporate AI in Fintech?

Frequently Asked Questions

What is the future of AI in the Fintech industry?

The future of AI in the Fintech industry is bright with improved technologies like open banking, Metaverse and Fintech, the rise of Gen AI, and more that can bring the financial landscape to greater heights.

How are AI and blockchain technologies integrated in Fintech?

AI and blockchain technologies are integrated into Fintech to improve security, prevent fraud, and enhance customer service. AI improves decision-making and predictions, while blockchain ensures highly secured transactions.

How is digital transformation reshaping the financial industry?

Digital transformation is reshaping finance by enabling personalized experiences, automating operations, creating new business models (e.g., neobanks), and facilitating quicker digital access. Blockchain, AI, and big data enhance security and customer insights.