Banks have consistently adopted the newest technological innovations to transform how customers communicate with them. It began with the introduction of ATMs in the 1960s, followed by electronic card-based payments in the 1970s. The 2000s marked the period of 24/7 online banking accessibility, and the 2010s brought in the phase of mobile-based banking on the go.

Today, we find ourselves in the age of AI-powered digital banking, driven by the coherence of aspects like cost-effective data storage and processing, wide-ranging technological access, and fast advancements. AI in banking has the potential to revolutionize the industry by automating tasks and enhancing decision-making processes in terms of speed and accuracy.

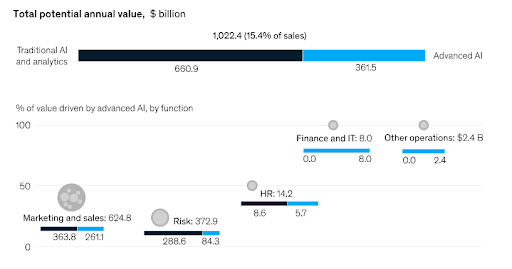

Reports indicate that around 80% of banks recognize the immense potential of AI in financial services. McKinsey predicts that AI’s impact could reach up to $1 trillion in banking and finance. These numbers underscore the industry’s swift shift toward AI, aiming to enhance efficiency, service quality, productivity, and cost-effectiveness.

Why Banks Must Embrace AI Technology as Their Core Strategy?

Banks must prioritize AI in their core strategy and operations to avoid losing to rivals and alienating customers. Let’s see four prevailing trends compound this risk:

- As digital banking gains ground, customer expectations are on the rise.

- Top financial institutions are embracing cutting-edge AI tech to keep up.

- Digital ecosystems are disrupting traditional financial services.

- Tech giants are venturing into finance.

AI in finance and banking can enhance both customer experiences and workflows.

How is AI impacting front-office banking processes?

AI revolutionizes front-office banking procedures by enabling personalized customer interactions, chatbots, and real-time data analysis for informed decision-making.

- Initiate transactions effortlessly with Simple-to-pay facial scanning.

- Conversational chatbots for daily service requests.

- Virtual loan officers that understand your micro-expressions.

- Humanoid robots in branches to serve customers.

How is AI impacting back-office banking processes?

AI development services streamline back-office operations through automated document processing, fraud detection, and risk management, enhancing efficiency and accuracy.

- Use of biometrics for secure access.

- Machine vision and NPL for document handling.

- Detect fraud and cyber threats with machine learning.

- Monitor risks with real-time transaction analysis.

Use Cases of AI in Banking Revolutionizing the Financial Sector

AI for financial services has become a crucial aspect of our world, and banks have already started employing this technology in their products and services. Here are some significant AI applications in finance and the banking industry:

1. Enhance Security and Detect Fraud

In banking and finance, AI fortifies security by swiftly identifying and blocking fraudulent activities. Advanced algorithms scrutinize transaction patterns, enabling real-time detection of anomalies and potential threats, ensuring a robust defense against financial fraud.

2. Optimize Loan and Credit Procedure

Artificial intelligence in finance revolutionizes credit assessments by analyzing vast datasets to assess creditworthiness accurately. Banking institutions leverage AI-driven systems to streamline loan and credit decision processes, ensuring efficient, informed, and risk-mitigated lending practices.

3. Predictive Analytics for Informed Decisions

AI’s predictive analytics in banking equips financial institutions with foresight. By assessing historical data and market trends, AI app developers can provide informed decision-making, empowering banks to anticipate shifts in the financial ecosystem and strategize accordingly.

4. Helpful in Data Collection and Analysis

AI facilitates meticulous data collection and analysis in the banking sector. Automated processes streamline the gathering vast datasets, providing valuable insights that aid in data-driven decision-making and fostering efficiency and precision.

5. Effective Risk Management

AI’s analytical prowess enhances risk management in banking. It assesses potential risks, identifies patterns, and offers predictive models, empowering financial institutions to proactively manage and mitigate risks, ensuring a resilient and secure economic environment.

6. Streamline Banking Operations with Automation

AI in banking and finance enables process automation and optimizes operations. Repetitive tasks are seamlessly automated, reducing manual effort, minimizing errors, and enhancing overall operational efficiency, allowing banks to focus on strategic initiatives.

7. Customer Interactions Using AI Chatbots

AI-powered chatbots revolutionize customer interactions in the finance industry. Chatbots enhance customer service by providing instant responses and personalized assistance, addressing queries, and facilitating seamless communication, elevating the overall customer experience.

You can take the help of an experienced AI Chatbot Development Company to build an interactive chatbot that can be context-aware and resolve day-to-day banking queries efficiently.

8. Elevate Customer Experience

Artificial intelligence in financial services heightens customer experience by personalizing services. From tailored product recommendations to personalized financial advice, AI enhances customer satisfaction, enabling long-term relationships and loyalty within the financial industry.

9. Utilize Market Trend Analysis

The use of AI in banking services enables institutions to harness market trend analysis effectively. By processing vast datasets, conversational AI in banking provides insights into market dynamics, enabling financial institutions to adapt strategies and stay ahead in the ever-evolving financial topography.

10. Ensure Regulatory Compliance

Artificial intelligence in banking ensures regulatory compliance by automating compliance processes. Advanced algorithms monitor transactions, detect anomalies, and generate comprehensive reports, ensuring adherence to regulatory requirements.

You must partner with a reliable AI app development agency that can adhere to regulatory compliance in artificial intelligence applications.

Challenges of Integrating AI in Banking Successfully

The Integration of cutting-edge generative AI in banking certainly offers tremendous potential, but it has its share of challenges. Let’s delve into these hurdles:

-

Data Security

With the vast amount of data at stake in the banking industry, ensuring its security is paramount. Finding the right generative AI development company that comprehends the nuances of AI and banking and provides robust security options to safeguard customer data is imperative.

-

Dearth of Transparency and Explainability

High-quality, structured data is the foundation for training and validating artificial intelligence in financial services. It ensures that AI algorithms can effectively navigate real-world scenarios. Banks need to adapt their data policies to address privacy and compliance risks and ensure data is machine-readable.

-

Lack of Quality Data

While AI in finance industry excels at streamlining decision-making processes, it can inherit biases from past human judgments, potentially leading to inconsistencies. To prevent such calamities, banks must provide adequate explainability for AI-driven decisions and recommendations.

Understanding, validating, and explaining the rationale behind AI models’ decisions is crucial for maintaining a bank’s reputation. So, the benefits of AI in banking are massive, but you must choose a dedicated ML Development Services provider with in-depth knowledge of integrating AI solutions seamlessly.

In machine learning in banking industry, banks are presented with incredible opportunities for efficiency and innovation, but overcoming these challenges is vital for a successful transition.

Steps to Implement AI in Banking for Maximum Impact

Having explored AI’s applications in conversational banking, we now focus on the essential steps for banks to embrace AI comprehensively, focusing on four key factors: people, governance, processes, and technology.

1. Build an AI Strategy

The journey into adopting artificial intelligence and finance commences with creating a holistic AI strategy aligned with the organization’s objectives and values.

It is imperative to conduct in-depth internal market research to identify areas where AI can enhance existing processes. This strategy should be crafted in compliance with industry standards and regulations.

Furthermore, refining internal practices and policies concerning talent, data, infrastructure, and algorithms is crucial to providing clear guidance for implementing AI and machine learning in financial industry across the various functional units of the bank.

This strategic foundation ensures a smooth and successful transition towards integrating AI in mobile app development, bolstering the bank’s competitiveness and efficiency.

2. Craft a Value-Centric Strategy

The subsequent phase involves pinpointing the most valuable AI prospects that align with the bank’s overarching processes and strategies.

Following the identification of potential AI use cases in banking, the quality assurance team should rigorously assess their feasibility. They must meticulously scrutinize all dimensions and potential implementation challenges and, based on their evaluation, choose the most viable applications.

In the last step of the planning phase, it’s essential to outline the necessary AI talent. Banks can consider outsourcing or partnering with cybersecurity consulting services to access the requisite expertise if these skills are not readily available in-house.

3. Develop and Implement

The next crucial step for AI in banking is to set their plans into motion. Rather than leaping directly into creating a full-fledged AI system, beginning with building prototypes is prudent. These prototypes are valuable tools to gain insights into the technology’s limitations.

To test these prototypes effectively, banks must compile pertinent data and feed it into the algorithm. The AI model relies on this data for training and development, emphasizing the importance of data accuracy.

The automation testing phase simulates real-world conditions, providing the development team with insights into the model’s performance.

4. Operate and Maintain

Deploying AI in banking necessitates ongoing vigilance and fine-tuning. Banking and AI should establish a regular review process to thoroughly assess the ML model’s performance. This proactive approach is vital for cybersecurity management and ensuring efficient operations.

As new data constantly influences the AI model during operation, banks should take necessary steps to maintain the quality and fairness of the input data to sustain optimal performance.

Envisioning the Future of AI in Banking

In response to escalating customer expectations and the challenges posed by AI and financial services in the digital age, an AI-centric bank will provide offerings and experiences characterized by intelligence, personalization, and omnichannel accessibility. These experiences will seamlessly integrate banking capabilities with pertinent products and services to fulfill evolving customer demands.

Role of AI in Retail Banking: A Customer-Centric Perspective

Let’s illustrate how an AI-enabled bank could engage a retail customer throughout the day. The particulars of the customer are given below.

Name: Justin

Age: 25

Occupation: Working Professional

-

Effortless Integration with third-party apps

Example: The Bank application recognizes Justin’s spending patterns and suggests restaurants at nearby places.

-

Biometrics for smooth payments

Example: Justin utilizes smile-to-pay to initiate payment.

-

Offers suggested by comprehensive analytics

Example: Justin gets 2% off health insurance premiums based on her gym activity and sleep habits.

-

Customized solutions for effective money management

Example: The app provides money-management and savings solutions to prioritize card payments.

-

Comprehensive insights into daily activities

Example: Justin receives an end-of-day overview of his activities, with augmented reality and reminders to pay bills.

-

Guidance on savings and investment strategies

Example: Justin receives an integrated portfolio view and various actions with the potential to augment returns.

How SparxIT Empowers Your Transformation with AI in Banking Solutions

As a prominent digital transformation Company, SparxIT specializes in delivering premium FinTech software development solutions. We collaborate with banks and financial institutions to craft bespoke AI and ML-based models to boost revenue, cut costs, and mitigate risks across diverse departments.

Our adept professionals possess a profound understanding of artificial intelligence. We have introduced Tara, our groundbreaking AI-powered Robo employee, designed to address in-house employee queries swiftly. Banks can leverage our innovative software to build a robot-assisted workforce, enhancing efficiency in resolving customer inquiries.

Contact our experts to execute a comprehensive, technology-driven AI strategy tailored to meet your banking needs effectively.

Frequently Asked Questions

Q1: What is the cost of implementing AI solutions in the banking sector?

A: The cost of integrating AI in banking varies depending on factors like the project’s scope, the complexity of the AI solutions, and the institution’s particular requirements.

Q2: How long does deploying AI technologies within a banking institution take?

A: The timeframe for deploying artificial intelligence in banking can vary widely. On average, it may take around 6 months to 1 year, depending on the project’s complexity, the readiness of existing systems, and the customization required.

Q3: How can you ensure the privacy of sensitive financial data?

A: Security and privacy are paramount in AI implementations. We employ robust encryption, access controls, and compliance with data protection regulations to safeguard sensitive financial information.

Q4: Can existing banking infrastructure seamlessly integrate with AI solutions?

A: Our AI solutions are designed to be compatible with existing banking infrastructure. Some modifications may be necessary, and a phased approach to integration is often recommended for a smoother transition.