Delivering Value to Clients Worldwide

Impact-first Projects We Have Delivered

Discover how we have delivered tangible results and created lasting value across industries.

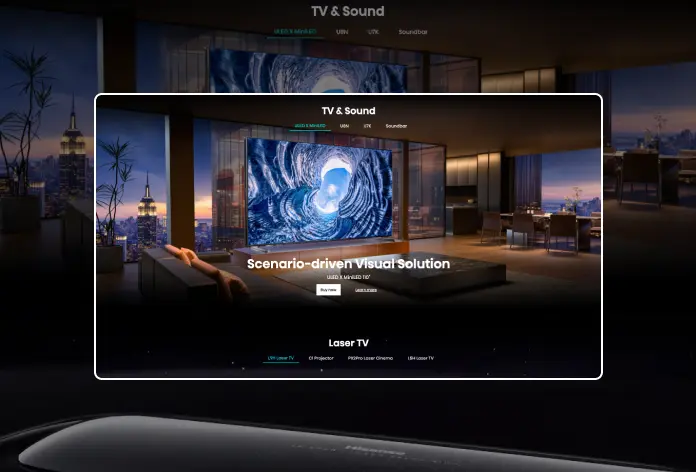

Built Hisense Over an AI-powered Auto-scalable Server

For Hisense, we boosted digital performance with a 30% traffic increase, AI-driven scalability, and Amazon EC2 auto-scaling for seamless responsiveness, ensuring an engaging user experience and higher conversions.

Know More

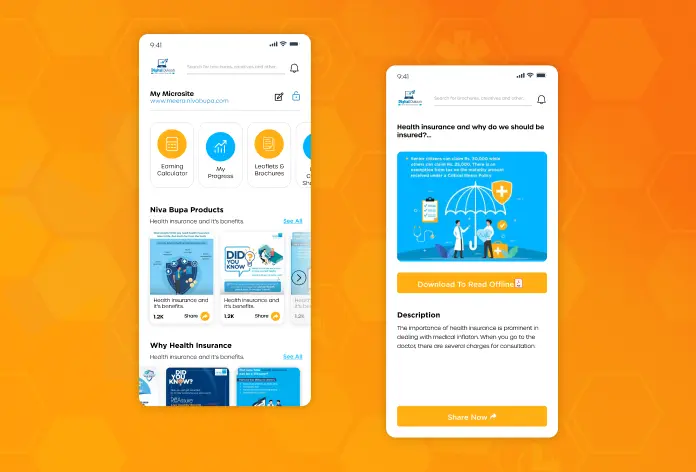

Nurtured Niva Bupa's Talent with Digital Induction

We built an AI-powered induction platform for Niva Bupa, featuring intuitive design, online assessments, and real-time feedback to streamline onboarding and enhance employee success.

Know More

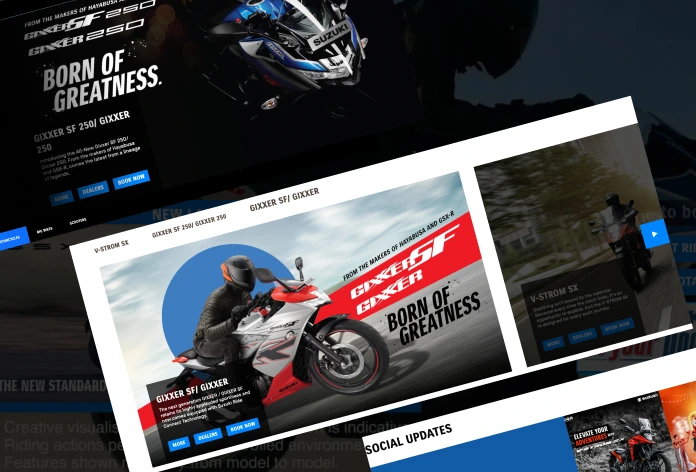

Suzuki Digital Acceleration on the AI Race Loop

SparxIT revamped Suzuki's digital ecosystem with an AI-powered website, POSM updates, AWS server management, and streamlined lead and stock management, enhancing customer experience and operations for growth.

Empowering Ecosystems with Intelligent Technologies

Supercharging your IT infrastructure with intelligent solutions to streamline processes, ensure scalability and growth.

Innovate with usGlobal Recognition and Awards

Accorded as a leading AI-first tech partner, our customer-centric solutions define industry standards.

- 2024

- 2023

- 2024

- 2023

- 2024

- 2023

- 2022

What Our Clients Say

Words from our partners commending our tailored digital solutions.

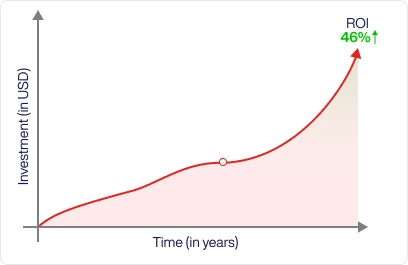

Want to be among the top 1% of companies generating higher ROI from digital transformation?

Generate more leads to outperform your competitors. You can achieve your business goals faster with a 200% increase in efficiency.

Partner with us todayCatalyze Business Growth With AI-Augmented Solutions for Industries

We deliver value-driven and customer-centric business transformation solutions backed by cognitive tech across diverse verticals, addressing specific challenges.

Providing Expertise Across a Range of Industries

Delivering Measurable Outcomes that Supercharge Your Business

Years of Delivering Excellence

Average Increase in Conversion Rates

Years of Average Partnership Length

Experts with a decade-long domain experience

What Sets Us Apart

With a decade-long proficiency, SparxIT presents you with future-ready digital solutions.

Looking to supercharge your business idea? Collaborate with us

Our Future-Ready Products Designed for Business Excellence

Our AI-powered digital products are custom-built to address key challenges, enhance productivity, and streamline operations with intelligent, secure, and feature-rich solutions.

Build eCommerce Storefronts with MAC-based Architecture

Automate Conversations and Boost Conversions

All-Inclusive To-do List App to Simplify Everyday Tasks

Our Board of Featured Events

Discover the essence of our recent events, showcasing vibrant moments and connections that drive our mission forward.

View all eventsLatest Insights

Stay informed with our latest blogs, offering valuable knowledge and trends to empower your business decisions.